ERP Accounting Module

Master any accounting operation in no time, regardless if it is a standard sales transaction or one of a kind operation

ERP Accounting module is an app that collects data and drafts reports of accounting operations, receivables, cash flows, payables, etc. It provides your enterprise with the necessary tools to manage financial issues.

You can significantly increase the performance of your company by automating tasks. Especially accounting tasks that require a high degree of accuracy. For this, you can always rely on your ERP. It gives you access to real-time data from any location. This implies that your database is updated immediately when changes occur.

The ERP Accounting Module is ideal for managing your company’s finances with an added advantage that it can be integrated with other modules or units. There will be no mistakes in calculations and also complete transparency. You will be able to see your company’s income and expenses. This information is used by the management staff to make better financial decisions and plan for projects.

Common features of every ERP accounting module

- Client database: Here, all the information about your customers is stored. You can give your employees access to clients' data such as credentials, financial transactions, and balance sheets. This is used to provide better customer service.

- Accounting system: it frees your employees from tons of paperwork. All your paperwork will become online reports and sheets that can be accessed by your employees.

- Asset management: This tool will help you manage your assets. You can monitor the assets through their life cycle.

- Financial analytics: It gives you the ability to monitor your receivables, payables, etc. in real-time from the dashboard. The UI is user-friendly and easy to understand.

- Forecasting: The accounting module gives you precise forecasts based on the present state of your enterprise and from reports.

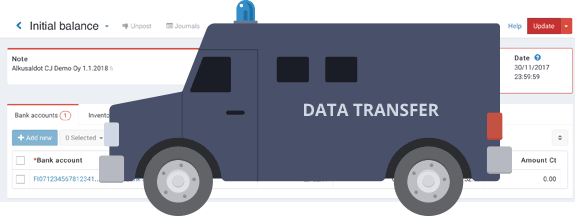

- Integration with different systems: The finance module should be able to exchange data with other apps or modules.

Now, you should know what to expect when getting an ERP finance module. This module also has its functions and subsystems — systems that we will talk about below.

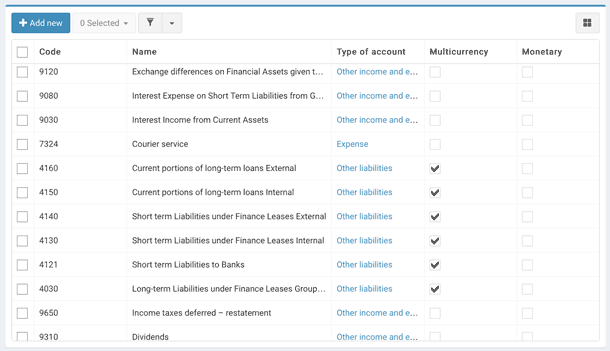

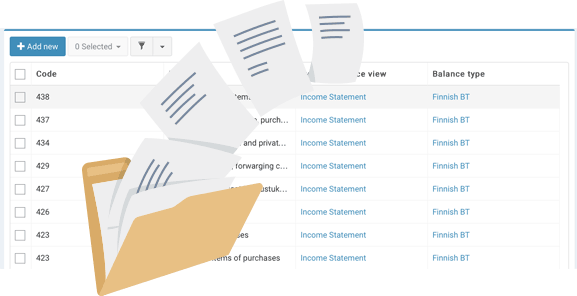

General Ledger

It is the heart of the finance module and gives you total control of data and its integrations with the different departments in your business. It provides a central location for accounting info needed for better decision making. All the summarized data about your finances can be found here. You are also able to set up Chart of Accounts used by your company.

Accounts Receivable

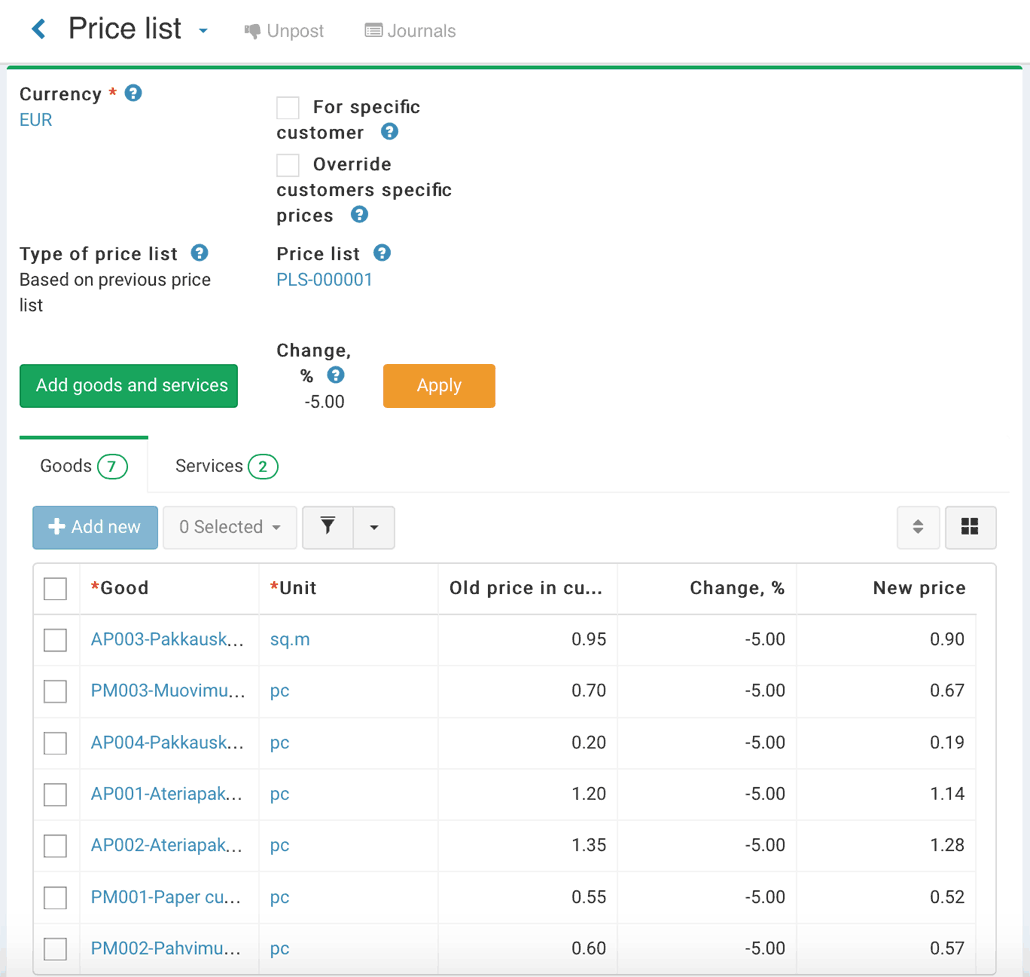

This subsystem takes care of the financial interactions with customers that use your enterprise’s outputs. It gathers finance receipts and performs tasks like tracking invoices for clients whose payments are pending. This function also allows you to classify your accounts. It provides you with a real-time credit management system. Your reports will have detailed analysis, and also statements from clients that owe your company payment. This system will also remind you about unpaid invoices.

Account Payables

This subsystem takes care of the input your enterprise provides in the form of products or services. It gives your company the ability to quickly register, track, and authorize incoming invoices. The form for approving invoices is simple to use. Invoices can also be generated automatically when needed. It can also match receipts with invoices automatically.

Asset Management

Fixed assets management is one of the main financial functions. This section keeps the assets ledger that provides data related to asset transactions. Assets management keeps track of your assets through their life cycle. It manages fixed asset investment and disposal, depreciation cost, revaluation.

Cash Management

All the data relating to the cash flow of your enterprise can be found here. It processes and analyzes all the money and bank transactions due to the payment of invoices. The cash management subsystem also analyzes financial transactions within a specific period of time and provides data on the source of income and use of funds to control liquidity. All this is important for your company to meet payment obligations.

Benefits of using the Codejig ERP accounting module

- Decreases the cost of running your company by eliminating unnecessary expenditure.

- The Codejig accounting module gives users the possibility to add or remove features. Therefore, you will end up with an ERP that is specific to your business.

- This accounting module gives you complete control over your companies finances, thereby ensuring productivity and customer satisfaction.

- You can manage your accounting operations from any location.

- The various departments of your company will be able to work with the financial department to ensure better decision making.

The finance department is one of the key sections of every business. Having good control over this department ensures that your company succeeds in this competitive era. There is no better way to manage it than using a good ERP system.